Both employees and employers may be interested in how to calculate withholding tax for their paychecks. And while the same basic information and calculations apply, there are very different priorities and planning involved for each party. Long story short, employees are most often concerned with making sure their end-of-year tax returns do not leave them with a huge tax bill, while employers must make regular and exact calculations without inflating their business’s accounting costs.

Why, When, and How to Calculate Withholding Tax for Employees

Many workers today find themselves in an unusual employment and household situation. An employee may opt to take out more of their pay in taxes as an informal way to compensate for a spouse who’s working as a self-employed contractor with larger payroll tax obligations. In a more common scenario, an employee may deliberately calculate the withholding tax to leave them with a larger refund at the end of the year as a savings mechanism. Still others may limit their income tax withholding so as to earn interest on those funds throughout the filing year.

Likewise, there are any number of situations in which an employee may want to make these calculations and fill out Form W-4, instructing their employer to withhold more or less of their income to offset their end-of-year tax liabilities. The most common is when you first get hired, but if you’re changing jobs in the middle of the year, you may have multiple income levels to average out. In some cases, an employer’s accounting department can make a systematic mistake that stands to leave you with a large refund or unpaid tax liability. This is another reason an employee may want to re-calculate their withholding tax in the middle of a tax year.

Here’s the good news: The IRS provides a taxpayer guide for filling out your Form W-4, complete with a personalized and interactive withholding calculator.

Examples for Calculating Withholding Tax

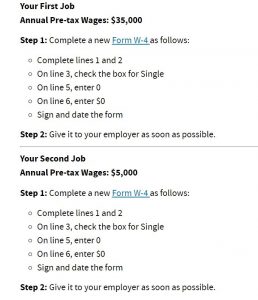

Laura is 23 years old and makes 35,000 per year as a junior account manager at a marketing firm. On weekends, she picks up bartending shifts to make some extra cash, adding around 5,000 each year to her income. Her filing status is Single, and her parents no longer claim her as a dependent on their tax return. She has no dependents to claim. Her primary job provides regular paychecks that are subject to federal income tax withholding, and she is paid every two weeks. She does not contribute to a 401(k) and takes a standard deduction. On her last paychecks, her company withheld $100 and the bar withheld $0. Laura enters her information into the IRS’s Tax Withholding Estimator and finds that her expected tax withholding will be $2,500, but her anticipated tax obligation will be $3,145. As a result, she will probably owe the IRS around $645 when she files her annual taxes. To change this, she completes a new W-4 form. The IRS provides the following advice:

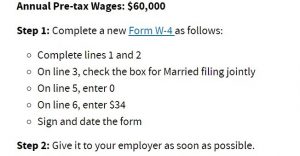

Steve and Jane are married and have two young children. They file jointly and claim their two kids as dependents, and they both hold jobs with regular paychecks subject to federal income tax. They are both paid every two weeks and make $60,000 annually each, but they do not expect to receive bonuses. On their last paychecks, their companies withheld $415. They don’t contribute to a 401(k) or an HSA/FSA. They take a standard deduction and enter their information into the IRS’s Tax Withholding Estimator. Steve and Jane find that their expected tax withholding will be $20,750 but that their anticipated tax obligation will only be around 12,755. As a result, they will likely receive a refund of $7,995. To avoid overpaying and decrease their refund, the IRS provides the following advice to both Jane and Steve.

Why, When, and How to Calculate Withholding Tax for Employers

Employers need to do more than just “ballpark” their withholding amounts. A failure to accurately report payroll tax liabilities and to deposit these funds in a timely manner can result in late penalties and the inevitable headaches involved in getting square with the IRS. As a matter of fact, employers have their own kind of special circumstances in which they may need to re-calculate withholding tax for quarterly filings. With large numbers of rounded calculations, there’s a very real possibility that these fractions of cents will create minor discrepancies between week-to-week and quarterly tax liabilities. (The IRS has you account for these discrepancies each quarter on Line 7 of Form 941.)

The raw numbers and percentages to calculate withholding tax are available from AMS here. It’s important to know these numbers for business planning and double-checking the books, but it’s also true that very few business owners and accountants still make manual calculations as their primary method for payroll processing. These calculations need to be made as an inherent part of writing payroll checks, but the deadlines for depositing these withholding funds are determined by your employer status as an annual 944 Filer or a quarterly 941 Filer, as well as your status as a monthly or semiweekly depositor.

Use Payroll Software to Calculate Paychecks

For a full-fledged business with competitive compensation packages and a large team of employees, other types of paycheck deductions and additions are also commonplace. This may include things like health plan contributions, retirement plans, health savings accounts, life insurance, and paid time off, just to name a few. In addition to automated withholding calculations, our payroll offers 40 User Defined Fields that can be used to customize the additions and deductions for your employees and their paychecks. Better yet, this information can be readily transferred to your quarterly and end-of-year filing forms. Check out AMS Payroll to make your payroll processing easy and reliable.